Description

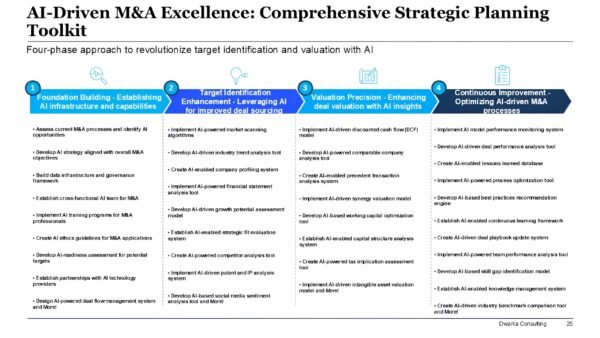

This Data-Driven Target Identification and Valuation in M&A) is a 150-slide PPT PowerPoint presentation (PPTX) with a supplemental Excel Model, which you can download immediately upon purchase.

BENEFITS OF DOCUMENT

- Precision Targeting: Focus on high-potential acquisitions that align with strategic objectives, leveraging AI’s analytical capabilities to uncover hidden opportunities.

- Accelerated Deal making: Transform months of manual work into weeks, allowing organizations to capitalize on fleeting market opportunities before competitors can react.

- Enhanced Value Creation: Unlock hidden synergies and mitigate risks through actionable AI insights, maximizing shareholder returns in an increasingly competitive environment.

KEY FEATURES OF THE TOOLKIT:

1. AI-Powered Target Scanning: Identify hidden acquisition opportunities that align with strategic goals, going beyond traditional search parameters.

2. Machine Learning Prioritization: Assess targets based on strategic fit, cultural alignment, and financial metrics, ensuring a comprehensive evaluation process.

3. Natural Language Processing: Analyze unstructured data efficiently, reducing initial company screening time by up to 50%, significantly enhancing operational efficiency.

4. Data-Driven M&A Strategy: Align with the growing trend of AI adoption in M&A, enabling organizations to stay competitive in a market projected to reach $2.9 billion by 2026, growing at a CAGR of 15.7%.

5. Accelerated Due Diligence: Streamline document summarization, risk identification, and regulatory compliance tasks using AI-assisted tools.

6. Predictive Analytics for Synergy Forecasting: Enhance accuracy in forecasting potential synergies and integration challenges through advanced analytics.

7. AI “Coaches” for Integration Teams: Provide real-time guidance based on best practices from previous M&A transactions, improving team capabilities and decision-making.

8. Automated Post-Merger Integration Tasks: Speed up integration processes by automating routine tasks such as policy harmonization and organizational structure alignment.

9. Real-Time Synergy Tracking: Monitor ongoing integration efforts to capture value quickly, addressing an average revenue growth decline of seven percentage points compared to peers when integrations lag.

10. Custom AI Training Programs: Develop tailored training for M&A team members based on specific roles and acquisition types.

11. Historical Deal Data Analysis: Uncover performance patterns from past deals to inform future strategies.

12. Post-Mortem Insights Generation: Continuously refine your M&A playbook based on lessons learned from completed transactions.

13. Scenario Planning with AI: Stress-test potential acquisitions by modeling various outcomes based on historical data.

14. Sentiment Analysis for Stakeholder Engagement: Gauge market reactions and stakeholder perceptions effectively during negotiations.

15. Optimal Deal Structure Identification: Use AI algorithms to determine the most favorable deal structures and financing options.

16. Regulatory Landscape Monitoring: Stay ahead of compliance issues by leveraging AI for real-time updates on legal requirements.

17. Competitor Analysis Automation: Anticipate market moves by analyzing competitor strategies through AI insights.

18. Talent Retention Strategy Optimization: Model effective talent retention strategies post-merger, addressing critical success factors in M&A.

19. Integration Playbook Enhancement: Update proprietary playbooks with insights from ongoing transactions to improve future performance.

20. Change Management Automation: Streamline change management activities during integration processes through automated solutions.

This toolkit serves as your organization’s AI-powered M&A command center, transforming your deal team into strategic architects capable of orchestrating complex transactions with unprecedented speed and precision. By harnessing the power of AI, you’ll not only keep pace with the rapidly evolving M&A landscape but lead the charge, turning each acquisition into a catalyst for transformative growth.

Consider this toolkit as your organization’s M&A crystal ball—providing clarity in the fog of deal-making while enabling you to play three-dimensional chess in the high-stakes game of corporate strategy. With this AI-driven approach, you are not merely participating in the M&A market; you are rewriting the rules of engagement and positioning your organization as a thought leader in intelligent deal-making innovation.

Reviews

There are no reviews yet.