Blockchain in M&A: A Lifeline for Uncertain Times (PowerPoint PPTX)

Original price was: $39.00.$32.00Current price is: $32.00.

Description

This Blockchain in M&A: A Lifeline for Uncertain Times) is a 150-slide PPT PowerPoint presentation (PPTX) with a supplemental Excel Model, which you can download immediately upon purchase.

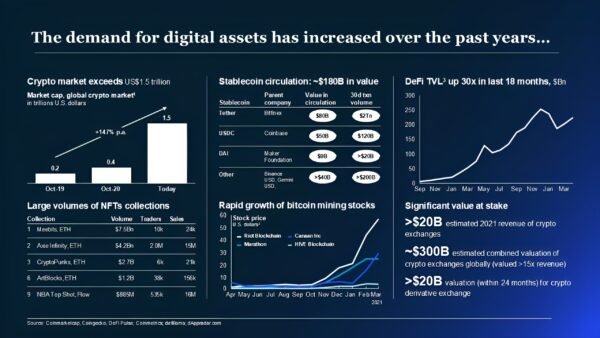

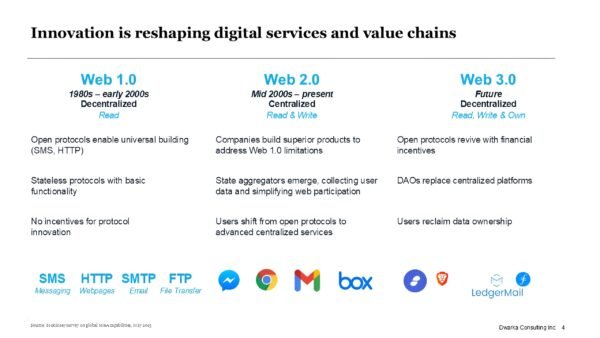

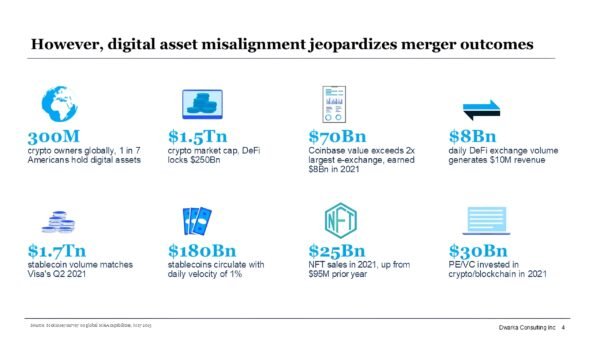

Blockchain M&A is reshaping the digital economy, with the industry’s market size projected to reach $469.49 billion by 2030. Despite recent fluctuations, the sector demonstrates resilience and strategic growth potential.

In this dynamic landscape, traditional M&A methods fall short as data volumes and target complexities surge. Organizations risk missing valuable opportunities or failing to maximize acquisition value.

Our AI-Driven Target Identification and Valuation toolkit is the compass for navigating the turbulent waters of blockchain M&A. This 150 PowerPoint slide toolkit with Excel model empowers C-suite executives to architect deals with unprecedented precision.

BENEFITS OF DOCUMENT

- Precision Targeting: Focus resources on high-potential acquisitions that catalyze growth.

- Accelerated Dealmaking: Compress months into weeks, seizing fleeting opportunities.

- Enhanced Value Creation: Unlock hidden synergies and mitigate risks through AI-driven insights.

KEY FEATURES OF TOPICS COVERED:

1. Data-Powered Target Scanning: Unearth hidden gems aligned with strategic goals.

2. Machine Learning Prioritization: Holistically evaluate targets for optimal fit.

3. Natural Language Processing: Slash screening time by 50%, supercharging efficiency.

4. Accelerated Due Diligence: Streamline risk identification and compliance tasks.

5. Predictive Synergy Forecasting: Enhance accuracy in projecting integration outcomes.

6. AI “Coaches” for Integration: Provide real-time guidance based on best practices.

7. Automated Post-Merger Tasks: Accelerate policy and structural alignment.

8. Real-Time Synergy Tracking: Capture value swiftly, outpacing competitors.

9. Custom AI Training Programs: Tailor learning for M&A team excellence.

10. Historical Deal Analysis: Leverage past performance to inform future strategies.

11. Post-Mortem Insights: Continuously refine your M&A playbook.

12. AI-Driven Scenario Planning: Stress-test acquisitions with data-backed modeling.

13. Sentiment Analysis: Navigate stakeholder perceptions during negotiations.

14. Optimal Deal Structure Identification: Craft favorable terms using AI algorithms.

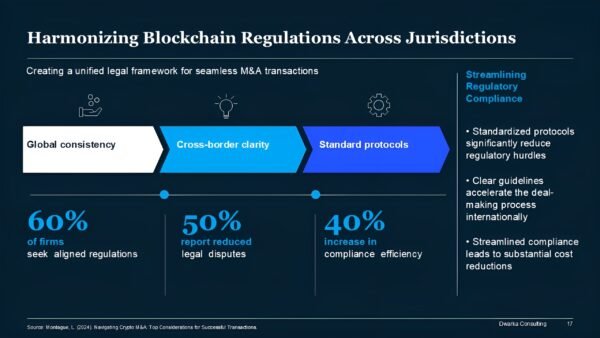

15. Regulatory Landscape Monitoring: Stay ahead of compliance curves.

16. Competitor Analysis Automation: Anticipate market moves through AI insights.

17. Talent Retention Optimization: Secure key personnel post-merger.

18. Integration Playbook Enhancement: Evolve strategies with real-time transaction insights.

19. Change Management Automation: Streamline cultural integration processes.

20. Data-Driven M&A Strategy: Align with AI adoption trends in a burgeoning market.

This toolkit is your Data-powered M&A command center, transforming your deal team into strategic architects. It’s your crystal ball in the fog of deal-making, enabling you to play three-dimensional chess in corporate strategy.

By adopting this approach, you’ll position your organization at the vanguard of deal-making innovation, ready to architect transformative growth in the blockchain frontier.

Reviews

There are no reviews yet.