Description

This Mastering Growth & Resilience: M&A Ecosystem Building is a 150-slide PPT PowerPoint presentation (PPTX) with a supplemental Excel document, which you can download immediately upon purchase.

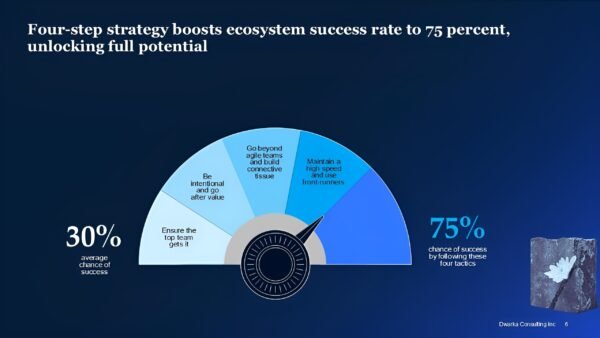

The M&A landscape in 2025 is poised for resurgence, with 75% of executives planning deals amid economic stabilization. However, heightened regulatory scrutiny and complex financing structures pose significant challenges to dealmakers.

Our “Mastering GROWTH & RESILIENCE: M&A Ecosystem Building” toolkit empowers organizations to transform their M&A capabilities, creating a robust ecosystem that drives sustainable growth and resilience. This comprehensive 150 PowerPoint slide deck and Excel model equips C-suite executives with cutting-edge strategies to navigate the evolving M&A landscape.

BENEFITS:

- Strategic Agility: Rapidly identify and execute high-value deals in a dynamic market, outmaneuvering competitors.

- Risk Mitigation: Navigate complex regulatory landscapes and stakeholder expectations with confidence and precision.

- Value Maximization: Optimize deal structures and post-merger integration, ensuring sustainable growth and shareholder returns.

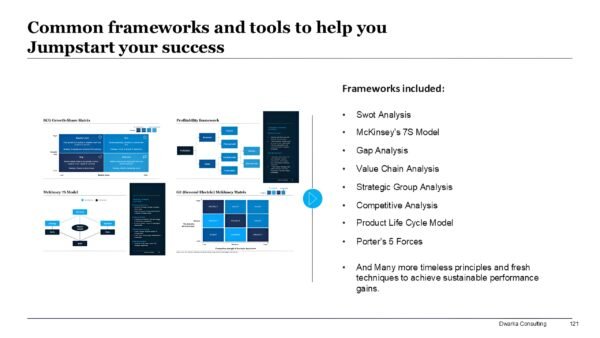

KEY FEATURES OF OUR TOOLKIT INCLUDE:

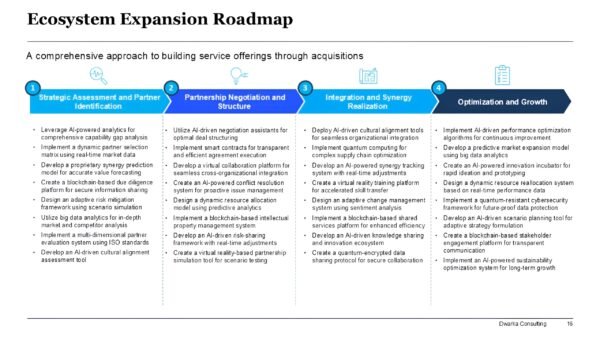

1. Data-Powered Target Identification: Uncover hidden opportunities aligned with strategic goals, solving the problem of inefficient target scanning.

2. Regulatory Navigation System: Streamline compliance with evolving antitrust and data privacy regulations, mitigating legal risks.

3. Valuation Gap Bridge: Implement innovative financing mechanisms to reconcile buyer-seller expectations, facilitating deal closure.

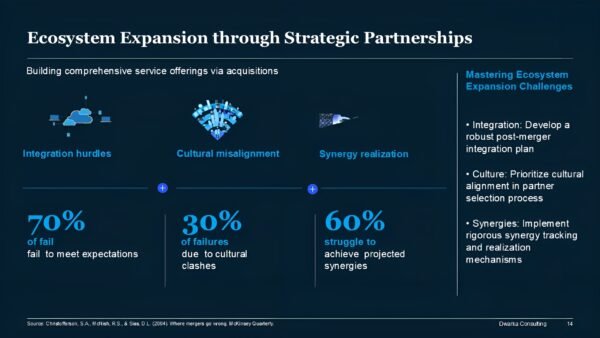

4. Synergy Optimization Engine: Maximize value creation through AI-driven synergy forecasting and tracking, addressing integration challenges.

5. Stakeholder Sentiment Analyzer: Gauge and manage reactions from shareholders, employees, and the public, mitigating reputational risks.

6. Cultural Integration Accelerator: Enhance post-merger success by aligning corporate cultures, and reducing talent attrition.

7. Digital Transformation Roadmap: Integrate technological innovation into M&A strategy, future-proofing acquisitions.

8. ESG Impact Assessment: Evaluate and optimize environmental, social, and governance factors in deal-making, and meeting stakeholder expectations.

9. Geopolitical Risk Radar: Anticipate and navigate global political and economic shifts affecting M&A transactions.

10. Talent Retention Strategizer: Develop targeted plans to retain key personnel during mergers, preserving intellectual capital.

11. Financing Optimization Tool: Model various debt and equity structures to minimize capital costs in a high-interest environment.

12. Regulatory Approval Probability Calculator: Assess the likelihood of deal approval, informing go/no-go decisions.

13. Integration Playbook Generator: Create customized playbooks for seamless post-merger integration, reducing operational disruptions.

14. Competitive Intelligence Dashboard: Monitor and analyze competitor M&A activities, informing strategic decisions.

15. Deal Structure Simulator: Model complex deal structures, including earn-outs and contingent considerations, to align incentives.

16. Synergy Realization Tracker: Monitor and accelerate the capture of projected synergies, ensuring deal value materialization.

17. Crisis Management Protocol: Develop robust plans for navigating unforeseen challenges during M&A processes.

18. Board Communication Strategizer: Craft compelling narratives to secure board approval and stakeholder buy-in.

19. Tax Optimization Modeler: Maximize tax efficiencies in deal structures across multiple jurisdictions.

20. Innovation Pipeline Analyzer: Evaluate and integrate target companies’ R&D capabilities, driving long-term growth.

Our toolkit serves as a strategic compass, guiding executives through the turbulent waters of M&A with the precision of a seasoned navigator. It transforms your organization into an M&A powerhouse, capable of architecting deals that not only withstand market volatility but thrive in it.

By leveraging our toolkit, you’re not just participating in M&A; you’re orchestrating a symphony of growth, where each acquisition harmonizes perfectly with your strategic vision. It’s the difference between playing chess and three-dimensional chess in the high-stakes game of corporate strategy.

Embrace this toolkit, and watch as your M&A capabilities evolve from reactive to proactive, from uncertain to assured. It’s not just about making deals; it’s about crafting a legacy of transformative growth and unshakeable resilience in an ever-changing business landscape.

-

Cross-Industry Acquisition for Digital Transformation (PowerPoint PPTX)

$39.00Add to WishlistAdd to Wishlist -

IT Regulation in M&A: A Step-by-Step Guide (PowerPoint PPTX)

$39.00Add to WishlistAdd to Wishlist -

Cultural Integration in Mergers & Acquisitions: Step-by-Step Guide

$39.00Original price was: $39.00.$33.00Current price is: $33.00.Add to WishlistAdd to Wishlist -

M&A Success: Powered by Best Practices to Increase Value (PowerPoint PPTX)

$39.00Add to WishlistAdd to Wishlist -

Blockchain in M&A: A Lifeline for Uncertain Times (PowerPoint PPTX)

$39.00Original price was: $39.00.$32.00Current price is: $32.00.Add to WishlistAdd to Wishlist -

Talent Acquisition through Strategic M&A (PowerPoint PPTX)

$39.00Original price was: $39.00.$34.00Current price is: $34.00.Add to WishlistAdd to Wishlist

Reviews

There are no reviews yet.